by Peter A Arthur-Smith

“We are so busy pursuing efficiency that we’re increasingly producing cheap, short-term solutions at the expense of elegance and building formidable advantages.”

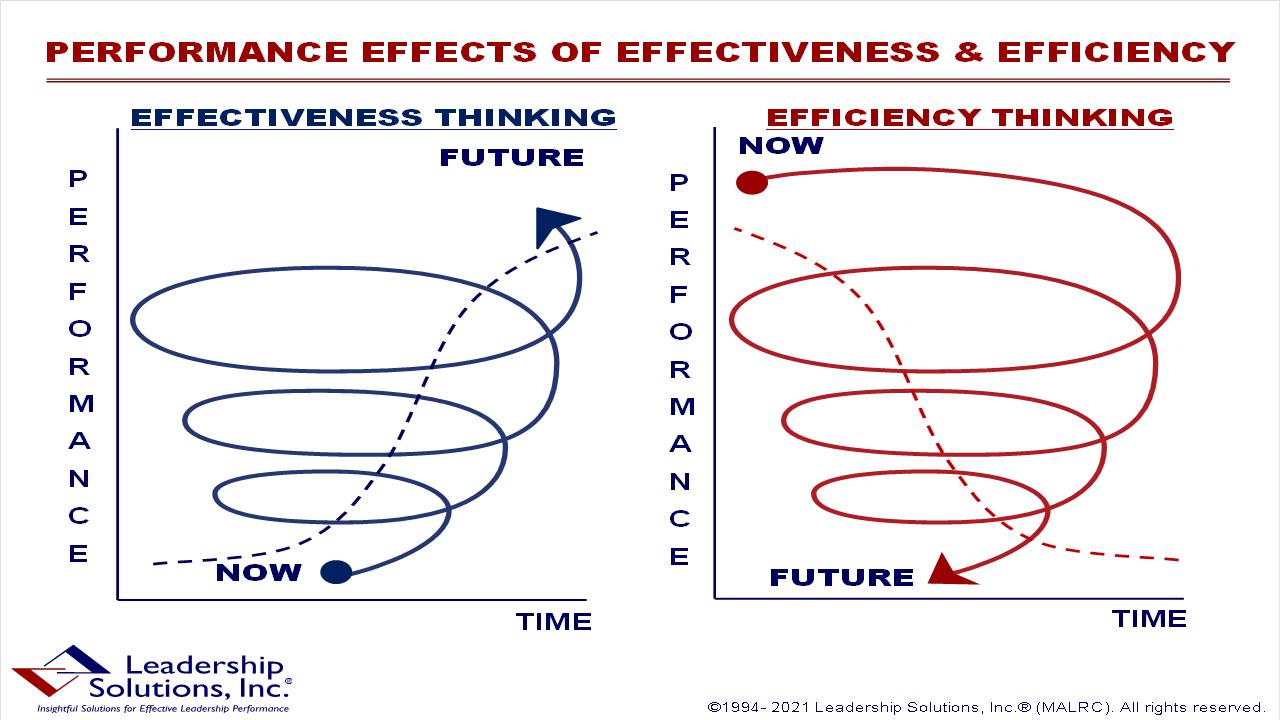

Take a look at the adjacent pictograph that defines the longer term dynamics of both effectiveness and efficiency. It underscores that if we keep squeezing and cost-cutting to maximize profit, at the expense of effectiveness and its innovation and elegant solutions, our operation is ultimately doomed. This is the reality of Wall Street’s impact and the business climate of today. Wall Street’s drumbeat for efficiency by any measure is its euphemism for maximum profit, no matter the consequences!

Not that we should deny Wall Street’s constant push for profitability, since profit is the lifeblood of any business venture. Profit gives us the room to breathe, think, and excuse to remain in business. But when efficiency undercuts our venture’s long term future, it’s time for a serious reset. Our efficiency obsession also undermines our quality of life, which then deteriorates over time to the point where we feel short-changed, depressed and constantly under pressure. While we have to respect Wall Street’s ambitions, we have to know when to push back and attain an optimum balance for the sake of society’s long term health and well-being.

Take the example of Whole Foods that more recent American icon of national supermarket success. It was where you could be assured of quality foods, good service and a customer friendly atmosphere. So many times you found yourself in fairly lengthy, fast moving queues because of customer popularity. However, the 2008-9 Great Recession caught it off guard as cash strapped customers fled to find the cheapest groceries at bare-bones stores: stores where products were still in opened boxes, shelving was second-hand, and minimal wage, cash-desk staff.

The Great Recession also gave the growing private-equity firms the breakthrough to apply their efficiency formula – often to provide bare bones service with the cheapest products/service that a firm could get away with and remain in business. The profits from this formula went to the private-equity firm’s investors. More than one private-equity related firm applied enormous pressure, through their equity stakes in Whole Foods, to improve its bottom line during the recession or sell-out to p-e firms – so they could apply their efficiency formula…customer service be damned! To snub these p-e related firms, the owners of Whole Foods sold out to Amazon, which was working hard to channel its online grocery and household orders to customers. Whole Foods with its many nationwide stores provided that possibility.

Predictably, Amazon was an efficiency house too, since its founder, Jeff Bezos, came from Wall Street. Whole Foods purchase price had to be paid for and elegant service was secondary to Amazon’s efficiency ethos. So it wasn’t long before marginal profit stores were closed, butcher’s counters were converted to deep-freeze refrigerators, fresh products were restricted, and check-out staff was hard to find in lieu of self-service checkout screens. The long, fast moving customer lines have disappeared and foot traffic largely consists of bargain hunting shoppers – the largest percentage of consumers.

Take my recent experiences with Hilton Hotels at a location in Florida adjacent to my client’s home office. Likely spurred by the recent pandemic and the huge drop off in hotel customers, Hilton switched to a survival mode. As it clawed its way back to a fully functioning hotel, it’s more than possible that its management switched to an efficiency mindset. It has revamped the hotel and what was a pretty elegant place with long serving staff has now become a pretty bare-bones house. What staff you can find is clearly of a bare-bones level and the furnishings have all been replaced with minimal cost alternatives. Its whole ambience and staff are a lower standard and it feels like a travelling salesperson’s hangout, but you still pay elegant prices!

Then there’s the recent Wall Street Journal story about national quality sandwich store chain Jersey Mike’s. Thirty years ago a young man worked his summers on the New Jersey shore in a lone fresh sandwich store. Luckily the store owners put it up for sale at $150,000 and Mike’s mother helped him find the money to buy it. He subsequently changed its name to Jersey Mike’s. He has done so well with its personal service, fresh sandwiches, and giving local community support that it has expanded to over 2000 stores across the country. During the pandemic it made news headlines by providing free fresh food to kitchens for hungry people.

It made WSJ business headlines recently because Mike sold out his family business – he, his wife and daughter were the sole proprietors – to private-equity behemoth Blackstone Corporation for $8Bn. What’s the betting that it’s only a matter of time before Jersey Mike’s converts from an effective, innovative and quality business to an efficient, bare-bones outfit to support any growth plans. After all, its 8Bn price tag has to be recovered and Blackstone’s investors will be looking for their regular pay off in profit sharing and stock price.

These are just three examples of a many thousands where the former standards of elegance are fast disappearing. Unfortunately the upcoming generations won’t know any different because they’ve become used to new “efficiency” standards. In addition, they have become exposed to the daily pressures of cost-cutting and cheap, short-term solutions, while the private-equity field works its squeezing, maximum share price magic. Are the days of elegance over? I fear that we’ve become so obsessed with short-term efficiency that we’re being squeezed out of exposure to the finer things in life just so that some people can make money. Meanwhile, those private-equity investors take advantage of those few enclaves of elegance that are left. Where’s the balance?